With the emergence of innovative technologies and new regulations meeting new challenges (decompartmentalization, instantaneity, lower costs, progressive replacement of fiduciary and paper documents, etc.), the world of payments is witnessing major changes that are likely to transform the world of cash management and the treasurer’s profession. Among these ongoing changes, Open Banking and PSD2 are having a very significant impact on the banking sector.

PSD2: Definition, Impacts and Constraints

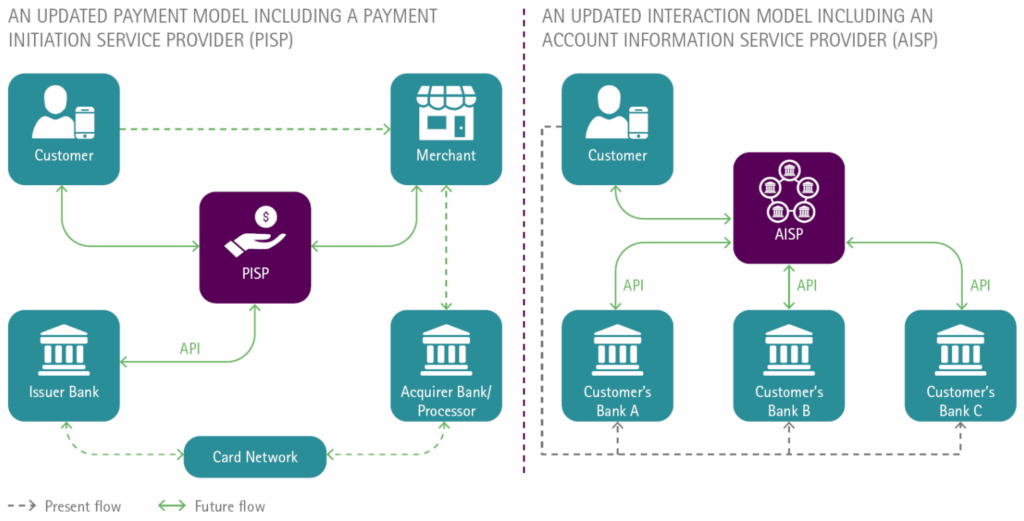

PSD2 is the second European Payment Services Directive. This revision of PSD1 is designed to simplify the use of electronic payment services on the Internet, to make them more secure and to lower the associated costs through “payment initiation” services that put the merchant and the buyer’s bank in direct contact with each other. In addition, it sets new rules (eg SCA: Strong Customer Authentication) and require banks to share account data with new financial market players, often referred to as “fintech” companies.

The PSD2 regulation creates two new statuses for these “fintech” service providers, accessible to approved third parties, whether banks or non-banks, who have obtained prior authorization from a national central bank, such as the Banque de France:

- Account Information Service Provider (AISP)

- Payment Initiation Service Provider (PISP)

These companies are authorized to develop new services related to the aggregation of account data (grouping of accounts, instantaneous transaction information…) or payment initiation (request for bank to bank transfers via a PISP online software application). Fintech offers to retrieve all available account information or initiate “multi-bank” payments from a single application.

Hence, while banks previously had their own data, they now have to share it with new market players (and other banks). At the same time, they are discovering the possibility of developing new services for their customers, in particular multi-bank customers, sometimes thanks to the acquisition of fintech startups that have become subsidiaries.

The PSD2 regulation creates two new statuses for these “fintechs”.

If the PSD2 aims to accelerate technological progress in the financial field and to reshuffle the cards in the banking sector, its success is on the way, subject to massive and international adoption.

From PSD2 to Open Banking

Among these technological advances, Open Banking is part of an obligation given to banks for the implementation of the PSD2 regulation, officially applied since January 2018.

Open Banking, supported by PSD2 and other non-European initiatives (e.g. Real Time payment – RTP network in the USA), opens up access to financial institutions’ data via Application Programming Interface (API) technology. Since 2019, banks have been obliged to offer standard, documented APIs for accessing their data, or to adopt one of the market standards such as the API Berlin Group.

Through this “banking opening”, the objective is to introduce more competition in order to make the market for payment services more competitive, fairer, more secure and, above all, less expensive. As a result, the activities related to banking relationships are changing, particularly in the field of cash management, which is preoccupied with issues related to the “instantaneous” nature of flows.

Open Banking is part of an obligation given to banks for the implementation of the PSD2 regulation.

Open Banking and real-time cash management

Instant Payments (Europe), Faster Payments (UK), SWIFT GPI (worldwide)…

The birth and evolution of instant payment infrastructures represent challenges for treasurers, with a multitude of projects deployed around the world (SEPA countries, India, Singapore, Thailand, Japan, United States, i.e. more than 50 countries in total according to the French “Lettre du trésorier” #379), making the transition to (near) real time a reality.

This trend has been joined by the following:

- SWIFT’s instant cross-border payment solution (gpi – global payment innovation), which not only accelerates corporate payments, but also allows them to be tracked like a postal package.

- many new entrants using blockchain technology, such as Ripple

Although all these solutions are at different levels of maturity and use, they all share the problem of real-time management, involving the realignment of the quality control processes.

In response, APIs are the ideal tools to enable treasurers to switch from asynchronous batch management to real-time management via on-demand access to banking data. Third-party solutions (treasury management system – TMS – and payment platform used by large corporations), then connected to the banking APIs, can provide a transparent and instantaneous reporting of cash positions in real time and across multiple bank accounts.

Access to real-time data gives treasury departments the ability to make more efficient forecasts and reduce their exposure to foreign exchange and liquidity risks. By updating values and information on funding requirements, the cost of hedging is actually reduced as payments or receipts are made.

All of these factors, combined with the automation of processes within a TMS, should enable the treasurer to better anticipate and make more accurate forecasts, thus generating even more strategic and efficient cash management.

What next?

Looking a few years ahead, when real time will be prevailing in cross-border payments (with instant payments, among new trends), the exchange could be done automatically and in real time and instantly generate hedges. Combined with the possible automatic investment of excess cash according to certain rules previously defined by the treasurer in his/her cash management software (risk preferences, return, diversification…), part of the treasury tasks could be done not only in real time but also automatically.

At the same time, the evolution of the treasurer’s profession and the associated age-old procedures deserve to be questioned:

- Will cut-offs be abolished? Shifted?

- If the volume of payments that can be made 24/7 increases drastically, how will the central treasury be reorganized?

- How to manage the calculation of interest scales or the monitoring of cash flow forecasts on a smaller scale than that of the day? Does this monitoring tend to take place on an hourly basis, complicating both forecasting and reconciliation tasks?

From the democratization and the intensification of the use of fast payment means in the world and their integration in the market tools for companies (TMS, payment factories…) will emerge the first answers to the challenge of real time Cash Management.